Alternatives to Cashless ATMs for Cannabis Merchants

Visa warned that cannabis businesses using cashless ATMs violate their rules and could face penalties. Businesses that used them must now find alternatives, such as ACH and PIN debit-only transactions for cashless payments.

How Inflation is Impacting Payment Trends

During times of rising inflation, solutions providers can partner to give merchants capabilities to keep up with payment trends, including BNPL and increased credit card spending.

The New Era of the Omnichannel Restaurant

Consumers demand omnichannel restaurant experiences. VARs and ISVs must help their clients meet this demand with the right technology, including omnichannel payments.

A Checklist for Finding the Ideal Omnichannel Payments Provider

The ideal omnichannel payments provider evolves to meet new demands, is hardware- and processor-agnostic, and prioritizes payment security.

3 Growth Markets for Point of Sale ISVs and VARs

Three industries, cannabis, e-commerce, and automotive offer chances for VARs and ISVs who strategically adapt their point of sale solutions and services to capitalize upon these opportunities.

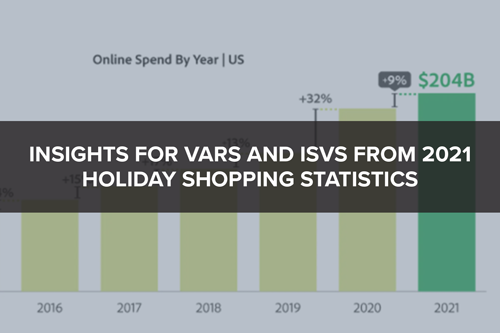

Insights for VARs and ISVs from 2021 Holiday Shopping Statistics

Based on 2021 holiday shopping statistics, consumers shopped earlier, used their phones, took advantage of the convenience of curbside pickup and used buy now pay later (BNPL) for online purchases.

Myths and Truths about Offline Payment Processing

Offline payment processing can keep a merchant open during an internet outage, but they need the facts to use this capability efficiently and minimize risks.

Why you should consider ACH as an alternative to cash discounting

Cash Discounting and ACH payments are both ways for merchants to minimize the costs of payment processing.

Why You Should Offer Loyalty and Membership Solutions to Your Clients

Membership solutions and loyalty solutions encourage return business, but they also provide merchants with a way to communicate with customers – even during a lockdown – and collect data that improves marketing ROI.

Will 2022 Be the Year Crypto Payments Catch On?

Consumer demand for Crypto Payments is growing, and tech is catching up, which could spark greater adoption.